The job market’s performance in the second quarter of 2024 is revealed through our latest analysis of the Bureau of Labor Statistics (BLS) Employment Situation reports from April through June.

This in-depth report highlights significant industry trends and developments, providing essential information for both job seekers and hiring managers. From emerging job growth areas to wage changes, we provide the information you need to stay ahead.

Join us as we dissect the second quarter Employment Situation Jobs Report, offering strategic insights to inform your decision-making.

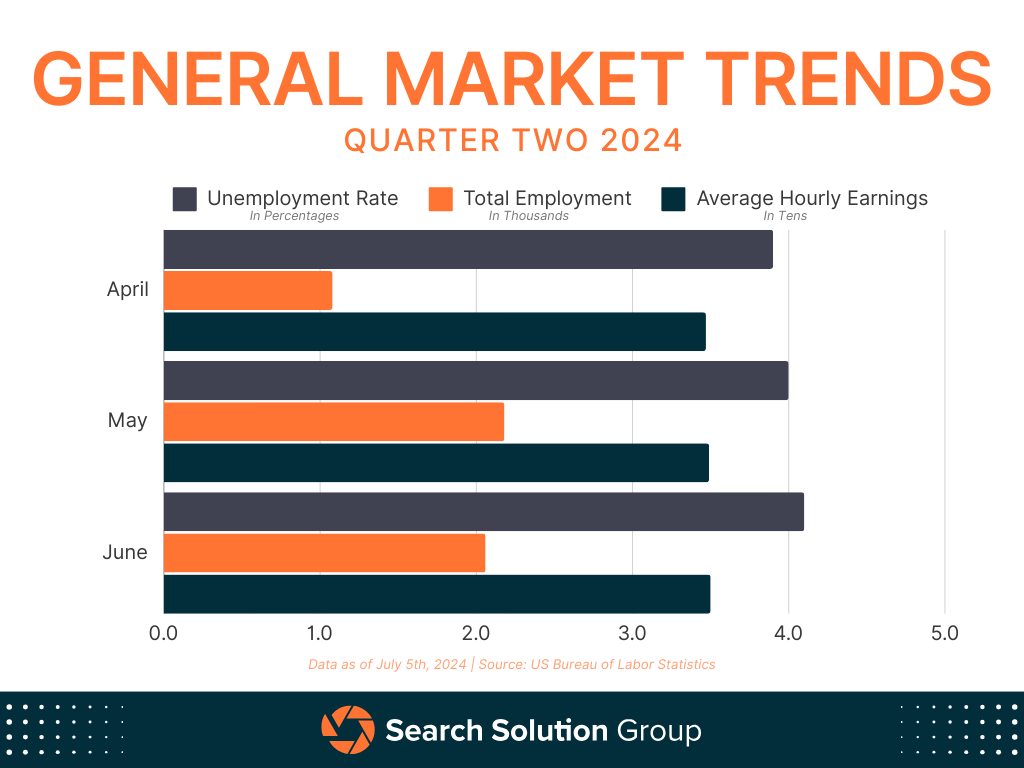

General Market Trend Breakdown

Unemployment Rate

In the second quarter of 2024, the unemployment rate gradually increased, starting at 3.9% in April, rising to 4.0% in May, and reaching 4.1% in June. This is the first time since November 2021 that the unemployment rate has gone over the 4% mark. These trends suggest a potential weakening in the labor market, indicating emerging challenges for both job seekers and hiring managers. Strategic adjustments in recruitment and employment practices may be necessary in response to these changes.

Total Nonfarm Payroll

Q2 2024 saw consistent job creation across various industries, though at a slower pace compared to the first quarter. April reported an addition of 108,000 new jobs, May saw a significant rise with 218,000 new jobs, and June added 206,000 new jobs, resulting in an average of 177,333 new jobs per month for the quarter. This represents a notable decline from the Q1 average of 276,300 new jobs per month. Despite this deceleration, the average monthly gain over the past 12 months remains strong at 220,000, reflecting sustained momentum in job creation.

Average Hourly Earnings

Average hourly earnings continued their upward trajectory throughout the second quarter of 2024. In April, the average wage was $34.75 per hour, increasing to $34.90 in May and reaching $35.00 in June. The Q2 average stood at $34.88 per hour, up from $34.30 in Q1 2024 and $34.13 in Q4 2023. Over the past 12 months, average hourly earnings have increased by 3.9 percent, highlighting a consistent trend of wage growth. This trend emphasizes the growing financial demands on employers to attract and retain talent in a tightening labor market, reflecting broader economic pressures and the importance of competitive compensation strategies.

Revisions and Final Notes

The June report released on July 5th revised and confirmed these figures, ensuring accurate and up-to-date data for informed decision-making.

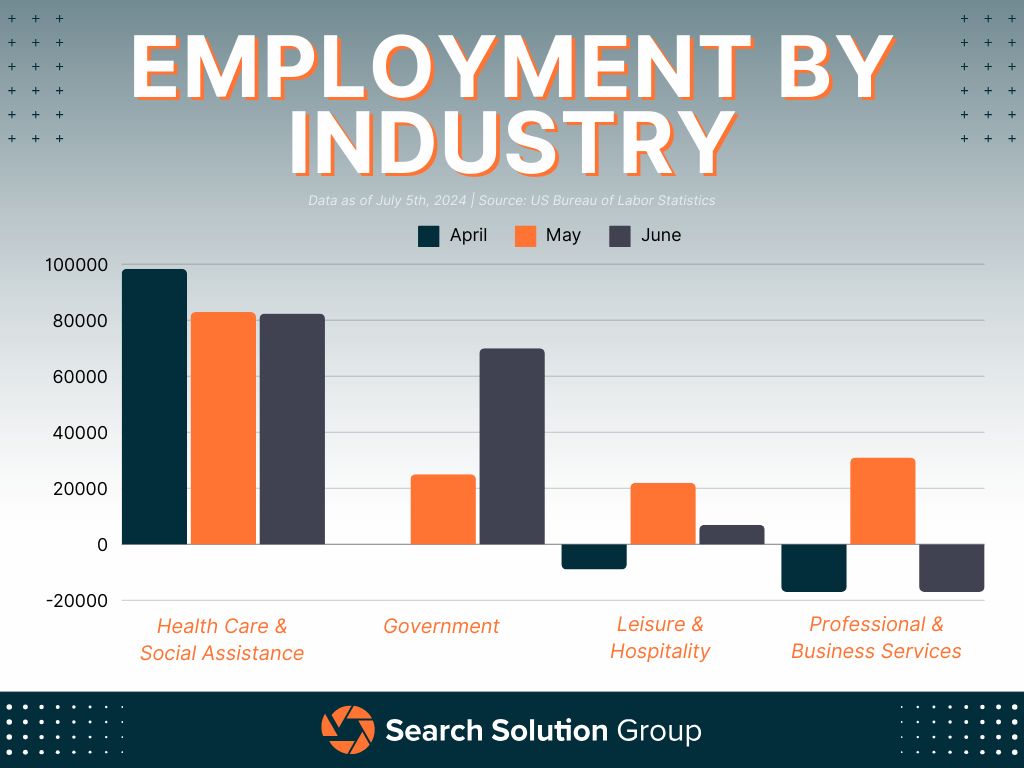

Industry-Focused Digest

The second quarter of 2024 presented a varied landscape across different industries, with shifts in labor force participation and employment gains. The labor force participation rate fluctuated slightly, maintaining a relatively steady trend over the year. This section delves into the specifics of employment changes in key sectors: Health Care & Social Assistance, Government, Leisure & Hospitality, and Professional & Business Services.

Health Care & Social Assistance

In the second quarter of 2024, the Health Care & Social Assistance sector saw significant growth, with 98,400 new jobs added in April, 82,900 in May, and 82,400 in June. This totaled 263,700 new jobs for the quarter, averaging 87,900 new jobs per month. This is an increase from the Q1 average of 79,900 new jobs per month and the Q4 2023 average of 76,000 new jobs per month. The sector’s continued expansion reflects the ongoing demand for healthcare services and social support, driven by an aging population and ongoing public health needs.

Government

The Government sector showed significant variation in job creation throughout Q2 2024. April saw no change, while May and June added 25,000 and 70,000 new jobs, respectively. This resulted in a total of 95,000 new jobs for the quarter, averaging 31,666 new jobs per month. Compared to the Q1 average of 64,666 new jobs per month and the Q4 2023 average of 50,600 new jobs per month, Q2 reflects a slower pace of government hiring. The fluctuation may be attributed to budgetary adjustments and seasonal hiring trends.

Leisure & Hospitality

The Leisure & Hospitality sector exhibited a slower growth rate in Q2 2024. April reported a decline of 9,000 jobs, while May and June saw increases of 22,000 and 7,000 jobs, respectively. This brought the total to 20,000 new jobs for the quarter, averaging 6,666 new jobs per month. This is a significant difference from the Q1 average of 89,000 new jobs per month and the Q4 2023 average of 33,000 new jobs per month. The sector’s reduced growth may be due to seasonal variations and changes in consumer behavior after the pandemic.

Professional & Business Services

The Professional & Business Services sector faced challenges in Q2 2024, with a net loss of 3,000 jobs. April and June both saw a reduction of 17,000 jobs, while May added 31,000 jobs. This resulted in an average loss of 1,000 jobs per month for the quarter. This decline follows a Q1 average of 24,000 new jobs per month and a Q4 2023 average of 2,000 new jobs per month. The negative trend may indicate a slowdown in business expansion and restructuring within the sector.

The trends in the second quarter of 2024 varied across key industries. The Health Care & Social Assistance sector continued to show strong growth, while the Government and Leisure & Hospitality sectors had more modest gains. The Professional & Business Services sector experienced a downturn, reflecting broader economic adjustments. These insights, based on the most recent data, provide a detailed understanding of the current employment landscape, which can assist in strategic planning for businesses and job seekers. The figures in this report were revised and confirmed in the June report released on July 5th.

SSG’s Key Takeaways

For Job Seekers

The second quarter of 2024 presents a mixed but hopeful landscape for job seekers. Despite a slight increase in the unemployment rate, there are still significant opportunities, particularly in sectors like Health Care & Social Assistance, which added an impressive 263,700 jobs in Q2. This sector continues to thrive due to ongoing public health needs and an aging population, making it a promising field for those with relevant skills and experience.

However, job seekers in the Professional & Business Services sector may face more challenges, as this sector saw a net loss of 3,000 jobs in Q2. This decline suggests a slowdown in business expansion and restructuring efforts. It’s essential for candidates in this field to stay adaptable and consider enhancing their skills or pivoting to related areas with stronger job growth.

The steady rise in average hourly earnings, which reached $35.00 in June, indicates that wage growth remains strong. This trend is beneficial for job seekers as it highlights the increasing value of labor and the potential for higher earnings. Those entering the job market or considering a career change should leverage this information to negotiate better salaries and benefits.

For Hiring Managers

The second quarter of 2024 offers critical insights for hiring managers, emphasizing the need for strategic adjustments in recruitment and employment practices. The gradual increase in the unemployment rate to 4.1% suggests a slight easing in the labor market, providing a larger pool of candidates. However, sectors such as Health Care & Social Assistance continue to experience high demand, adding 263,700 new jobs in Q2. Hiring managers in this field must remain competitive and proactive to attract top talent amidst ongoing demand.

In contrast, the Professional & Business Services sector’s net loss of 3,000 jobs highlights the importance of strategic workforce planning and flexibility in response to economic shifts. Managers in this sector should focus on retention strategies and consider upskilling existing employees to navigate the challenges posed by the current downturn.

The consistent increase in average hourly earnings, which reached $35.00 in June, underscores the growing financial demands on employers. To attract and retain talent, hiring managers must offer competitive compensation packages and consider additional benefits to stand out in a tightening labor market. Understanding these trends allows for more informed decision-making and better alignment with the current economic environment.

Conclusion

The second quarter of 2024 showed diverse trends across key industries, providing important insights for both job seekers and hiring managers. With strategic adjustments and informed decision-making, both parties can effectively navigate the changing employment landscape. The figures in this report were reviewed and confirmed in the June report released on July 5th, ensuring accurate and up-to-date data for guiding your next steps.

Upcoming BLS Reports for the Second Quarter

The job market is continuously evolving, influenced by emerging trends and developments. While the monthly Employment Situation Jobs Report offers a preliminary glimpse, it merely scratches the surface. In the coming months, the Bureau of Labor Statistics will release a series of in-depth reports detailing the job market dynamics of the second quarter. Want to stay informed and ahead of the curve? Keep an eye on these upcoming detailed analyses:

Friday, July 19th – State Employment and Unemployment for June 2024

Wednesday, July 24 – State Job Openings and Labor Turnover for May 2024

Tuesday, July 30th – Job Openings and Labor Turnover Survey for May 2024

Wednesday, July 31st – Employment Cost Index for Second Quarter 2024

Thursday, August 1st – Productivity and Costs for Second Quarter 2024

Friday, August 16th – State Job Openings and Labor Turnover for June 2024

If you found our analysis of the BLS Q2 Employment Situation Report insightful, let us help you navigate the complexities of hiring in today’s market. Reach out to our expert team at Search Solution Group for tailored solutions that meet all your recruitment needs. Together, we can build a workforce that not only meets but exceeds your expectations. Contact us today to get started!